This article was going to see the world a long time ago…

but as you know, it is dangerous to jump to conclusions.

So we at Fortifier decided we should understand what exactly the main problem is, become familiar with the technical and business processes, create a reliable solution, test it, and only then share our experience in order to answer the main question – how to improve the claims process?

And we did it!

Follow us through all stages of the process.

The Nature of the Claims Process

The Impact of Blockchain and Smart Contracts on the Claims Process in Insurance

The Nature of Blockchain and Smart Contracts

Conclusion

The Nature of the Claims Process

The insurance claim process consists of several stages, with each one having the potential to negatively impact client satisfaction.

In general, the claims process begins when a client experiences an insured loss—e.g., their car is damaged, they lose certain goods or data, and, sometimes even people’s houses burn down (as sad and frightening as it may sound). In such a sad case, it is time for them to request honest compensation from your dedicated agency. The whole procedure starts once the client contacts your broker. We will consider it as the first of several stages, with the whole procedure subdivided into 5 main steps.

When handling a claims process, an agency passes the client’s claim through several departments and specialized experts before the final resolution takes place and the compensation is issued. Depending on the case, the whole procedure can and should slightly differ. The basic set of tasks to complete, however, remains mostly the same in common cases and looks as follows:

- Broker contact – an insured client contacts a broker to describe the situation, shed light on all the circumstances, and send evidence if there’s any;

- Claim investigation initialization – an adjuster checks the reported claims process case in order to evaluate the ultimate loss;

- Policy review – an adjuster checks which points of insurance services are covered by a certain client’s policy and which are not;

- Assessment of damages – an adjuster may contact experts related to the field of a certain loss in order to provide a client with a list of recommended repair and restoration facilities they can go to in order to fix or restore particular losses;

- Issuing of payment – after a client gets everything they lost back or restored, an adjuster issues a final payment and assigns a period of time during which the client will get it, depending on the severity of a particular situation.

The Impact of Blockchain and Smart Contracts on the Claims Process in Insurance

The advanced claims processing software is the solution that helps to automate and facilitate many major parts of those seemingly simple 5 stages. Behind each stage, there is a complex task that requires a dedicated expert’s or whole departments’ time, with all the respective expenses hitting one’s wallet as a result.

With that in mind, being able to integrate an easier method to the claims resolution process is what will guarantee a pleasant customer experience and earn each customer’s loyalty, thereby retaining the policyholder’s account.

I’m sure each insurer knows about this chain.

But how can we solve these problems?

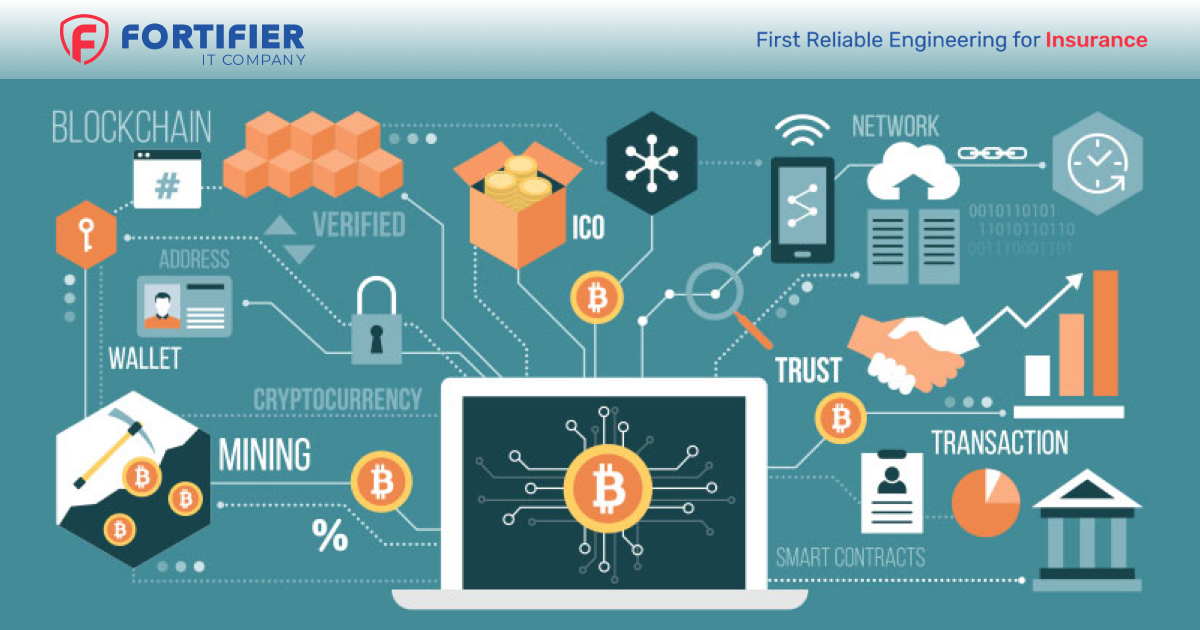

The answer is a modern word—Blockchain. Why is it so popular?

The Nature of Blockchain and Smart Contracts

On a basic technological level, blockchains provide an interconnected network of synchronized data storages without a single data controller or owner. The info put in these storages cannot be altered unless all key network users submit a common approval to do so. This is a powerful advantage in terms of the claims handling process, as it restricts a certain user’s capability to change and compromise important data at will.

Such highly-efficient restrictions make the involvement of any third parties obsolete. The thing is, trusted intermediaries can still pose risks in terms of data safety. And the fewer possibilities there are to affect any stored info in any practical way, the lower the risks are of it being suddenly and unexpectedly undermined.

Agreements of the network-involved users are regulated and managed by “smart contracts.”

Standard insurance contracts are cumbersome, filled with complex terms, and are generally difficult to understand for people simply trying to receive their honest compensation. On the other hand, there are also increased rates of fraudulent activities in any finance-related business niche.

Both of these integral issues can be practically eradicated with the blockchain-smart contracts combo—in particular, via the dedicated claims processing software that verifies the authenticity of every user info, state of transactions, and integrity of policies.

As such, the check and approval of the proper client claims to be compensated can be automated and firmly secured from any unauthorized breaches at the same time. The only essential condition here is that all involved parties form a cooperative network and agree to make further decisions as to any data alterations collectively.

The technology can even initiate claims payments autonomously—checking all the matching criteria and calculating the respective payment on its own. This is a great way to further minimize the human factor risks and accelerate claims processes.

People are afraid of losing their rightful data management capabilities. This can also be resolved with the enhanced efficiency and security of the management of the claims process flow, allowing personal data to be managed by its direct owner while making verification a solely blockchain’s automated responsibility.

Thus, the technology lets you reduce costs and boost the efficiency of many essential processes, which means a respective boost in service quality and income as well. According to the recent PwC research, 56% of companies approve and agree with the efficiency of blockchain while 57% are not familiar with the technology enough yet to make any statements in this aspect.

Conclusion

All right, guys, time to make our move.

It’s no secret that the finance industry, with all involved businesses and niches, poses significant transparency and trust issues. Frauds and scams are regular happenings that pose great risks for both companies and customers. And there is also the problem of underinsurance caused by the expensiveness of services and low efficiency of many substantial processes.

So know that every insurance company needs to take action today to figure out how blockchain technology can impact the way they do business now and in the future, as well as ultimately find out how to improve the claims process for both the in-house and customers’ benefit.

And of course, if you have any questions,

Fortifier Team is here.