Sweeping digitalization and modernization of practically all existing industries, business niches, etc. are more of a necessary measure than a trend-dictated whim of establishments and market players. Technologies develop, global service standards evolve, and participants of all the commotion must be able to follow.

Insurance is one industry that has been in need of some memory-efficient solutions for some time now, considering the vast volumes of data a single insurance agency might accumulate and generate. Big Data can be a real game-changer in this aspect. Let’s ponder on that.

How Big Data Is Revolutionizing Business

Colossal volumes of data are being produced in real-time by all sorts of industries, businesses, platforms, processes, etc. all the time. Big Data is the advanced technology that can take responsibility for all massive amounts of info and process it with AI-based capabilities. The results are highly important for common business models’ pieces of data.

In particular, Big Data helps to:

- Provide goods & services in new, efficient ways. Chatbots, virtual live chats, and assistants help to enhance customer experience and narrow down targeting for company marketing efforts.

- Automate workflow processes. A lot of manual work can be efficiently replaced by profitable automated capacities.

- Expand business model offers. Digital and peer-to-peer insurance can be established to stay versatile and capable amidst all the market competition.

New Ways to Extract Customer Data Emerge

Data processing and analysis have always been at the core of insurance. Customer categorization and fraud prevention measures, statistics, personal data, etc. — all of that needs to be sorted out, analyzed, and kept in a database for a prolonged period of time. Modern society, being covered all-around with digital everyday solutions and initiatives, spawns new sources of customer data, which helps to categorize and classify target audience even more efficiently and precisely.

These newly-formed sources include:

- Online environment. Social media networks, eCommerce stores, and browsing activity, in general, all may provide valuable data for processing.

- Internet of Things. Data extracted from sensors and all sorts of devices connected to the IoT, like Smart home tools, drones, vehicles, and such is another newly-emerging “data mine.”

What Big Data Means for Insurance

According to The Geneva Association’s Secretary General – Anna Maria D’Hulster –

“Going forward, access to data and the ability to derive new risk-related insights from it will be a key factor for competitiveness in the insurance industry. New approaches to encourage prudent behavior can be envisaged through Big Data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention.”

How can Big Data solutions enhance insurance right now in particular? Let’s take a look at a few examples, namely, you can:

Improve targeting

Big Data analysis allows targeting one’s marketing efforts straight towards the bull’s eye, helping to extract info from a multitude of online sources and web activity outlets that provide tons of customer data every day in real-time.

Retain customers better

AI and Big Data algorithms enable one to point out any spikes, fluctuations, and declines in customer satisfaction. You can automatically collect insights and see where major customer service dissatisfaction issues stem to efficiently solve them.

Manage risks insightfully

AI-powered predictive models can enhance your standard risk assessment procedures needed to take place in order to verify customer personal data. This makes it easier for insurance companies to acquire new, honest customers and classify them by potential risk specifics.

Identify and prevent fraud

Over $80 billion — that’s approximately how much insurance agencies in the US are obliged to spend on combating fraud. Predictive models may come into play here once again, allowing to juxtapose potential customer data with existing profiles classified as fraudulent.

Lower total costs

An insurance services provider can reach a new level of profits by automating many manual in-house processes. In particular, all the hardships related to claims processing and administration can be handled autonomously with automated Big Data tools.

Personalize service and pricing

Get an all-around major picture of what your customers want, need, and desire in particular. Integrating Big Data solutions with life insurance services, for instance, allows thoroughly checking all available related customer info — from medical history to online behavior patterns — and offering a personalized insurance product and price.

Accelerate in-house workflow

Anything related to analysis in your agency can be beneficially improved in efficiency and accelerated with Big Data algorithms. You can save up to 43% of the time most analysis-related processes take in-house according to McKinsley.

Employment of the Technology by Niches

The industry of insurance has already had some time to adapt and experience some game-changing capabilities Big Data provides. Let’s see how particular major fields of the industry employ this technology.

Health insurance

You can already adopt interactive policies that will be connected with various fitness apps and trackers. On top of that, a number of emerging data sources enhances customer targeting, as we’ve mentioned numerous times in the article.

The only concern here is the security and privacy of all involved data — everything must be thoroughly monitored and protected, which means more investments that, however, will pay off very well in the end.

P&C insurance

When it comes to the insurance focusing on property and casualty, Big Data capabilities allow identifying the connection between involved risks and client behavior efficiently and painlessly. For example, car insurance agencies can analyze data accumulated throughout the entire time a particular client owns a car, such as GPS tracking and fees’ record.

Travel insurance

This is where both AI and Big Data tech solutions can be used to the maximum extent “in all their glory,” so to speak. Travel insurance service providers are literally bombarded with customer requests and claims on an hourly basis, because this type of insurance takes no time, is cheap, and is based on fast decisions.

Customer experience in this aspect can be significantly enhanced with the help of the AI-BigData combination. You can automate everything from claim acceptance to client support chat and offer the most fitting options customers whose data was stored and analyzed within a centralized database.

How is the Insurance Market Expected to Grow in the Following 3 Years?

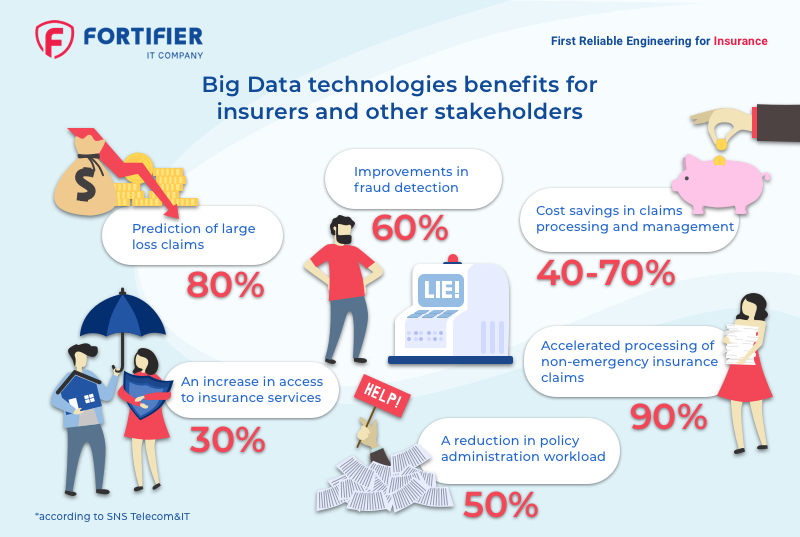

It is expected that global insurance providers are to invest over $3.6 billion by 2021 in advanced Big Data and AI tech — that’s what SNS Telecom&IT claims based on the research and polling. Thus, the thorough involvement of Big Data is to make insurer services 30% more accessible, 60% more protected from fraud, and 40-70% more cost-efficient. Cybercrime is also to be tackled more efficiently with advanced centralizing security means, and on-demand business models in insurance are to appear as well.

What Huge Efficiency Big Data with Predictive Modeling Bring to Insurance

Constantly analyzing various types of customer data flows lets you get your customer base better, indicate their behavior patterns, and define decision-making motivation points. With individualized policies, utterly exact risk assessment, efficient prevention of fraud, and in-house workflow enhancement, Big Data analytics is sure to yet turn the industry upside down.