Digital technologies are present in every realm of modern life. With change happening so fast, it can be challenging for insurers to innovate with confidence or even to know where to begin. Startups and enterprises invest billions of dollars in InsurTech innovation programs to modernize the industry. Business process automation, chatbots, machine learning, blockchain, and Internet of Things — thanks to the latest technology, insurance companies are minimizing the human factor and optimizing their performance. You might have heard about it, but what is InsurTech?

The insurance sector is in big need of changes. The following article focuses on the main insurance trends and highlights the most promising areas for startups.

Definition of InsurTech

The term “InsurTech” refers to the innovative technologies and new digital tools developed to optimize the performance of insurance companies, to deliver a better customer experience, and unlock the potential of advanced analytics. In a more narrow sense, the definition of InsurTech means the combination of insurance and technology to bring game-changing solutions into the business.

Some of leading industry experts put the definition of this peculiar niche the following way:

“Insurtech is technology that supports the digital evolution of insurers. It drives strategic and IT priorities while disrupting/collaborating the business processes and models of one of the world’s largest industries.”

— Michael J. de Waal, Global IQX

“Insurtech is the crossroads where legacy insurance enterprises, digital platforms, and technological innovation meet. Insurtech will continue to disrupt all aspects of insurance: supply chains, customer service, products, and much more.”

— Robin Smith, WeGoLook

InsurTech Market Size

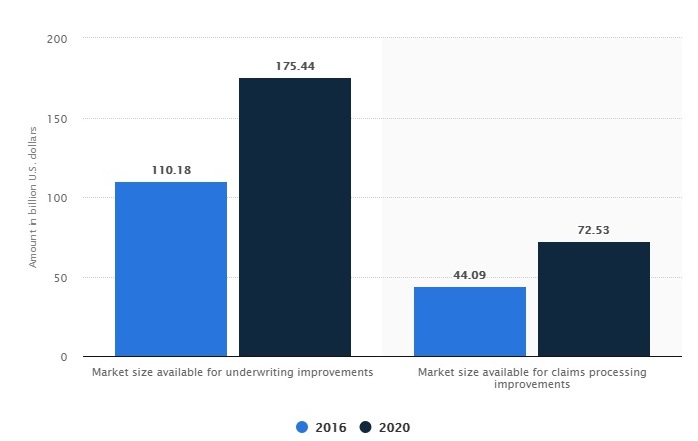

According to the latest reports and statistics, the global InsurTech market size will continue to grow. The growth of revenue will hit the point of $1,119.8 million by 2023. Statista mentions the improvements in claim processing in the USA and worldwide. Using new technology, insurers proceed to claims faster and more efficiently.

Over the past several years, the FinTech industry realized the need to integrate the InsurTech solutions into their working routine. It means potential cooperation between these two sectors, providing more opportunities to the vendors, brokers, analysts, and consumers.

How InsurTech is Changing the Insurance Industry

New tools and applied technologies change the way traditional insurers think about their development. That is why more and more insurers are embracing InsurTech to:

- make underwriting and actuarial decisions faster and better;

- deliver better customer experience;

- unlock the potential of advanced analytics;

- drive cost savings with greater operational efficiency.

New technology in the insurance industry provides game-changing solutions to fill both gaps in capabilities and offerings and enhance processes across the insurance value chain. For example, there are:

- predictive analytics applications for customer acquisition, risk assessment, and policy development;

- white-label platforms that allow brokers to sell short-term insurance products via any distribution channel;

- computer vision with geospatial imagery solutions to improve underwriting quality and efficiency;

- AI and data science developments for fraud detection, etc.

All the innovations help exchange data in a more modern and meaningful way.

“InsurTechs provide insurers access to additional data sources, reduce the technology execution risk for early-stage technologies, and enable faster time to start up new product lines or segmental offerings.”

— Derek Wilcocks, Group Chief Information Officer, Discovery

Use of Emerging Technologies in the Insurance Sector

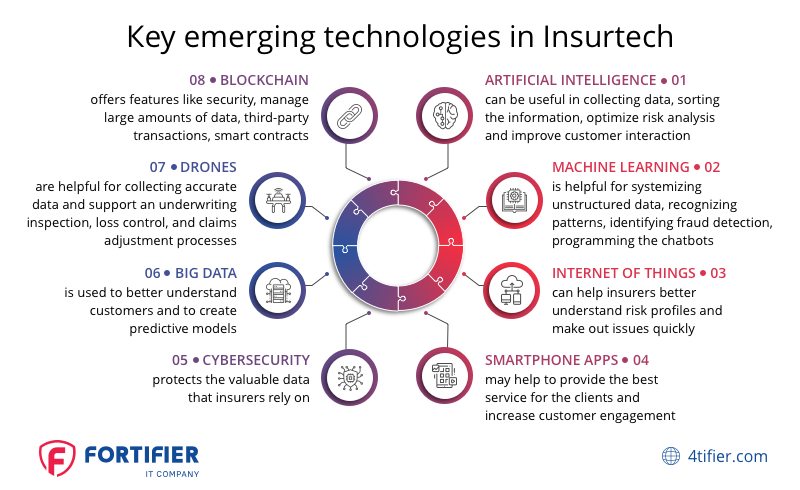

Emerging technology changes the way how insurance companies work—and these changes are more than in place. Global insurers focus on improving digital capacities right now to be “battle-ready” and be able to adapt both to shifting market scenarios and evolving customer demands in the future. Here is the InsurTech overview of the cutting-edge solutions that will transform the insurance business in the near future.

Artificial Intelligence

The insurance industry was one of the first to start using artificial intelligence-based technologies to automate repetitive processes, optimize risk analysis, and improve customer interaction. With the sweeping power of AI at your side, you can, for instance:

- deploy bots that would review claims autonomously and save your InsurTech business loads of manpower resources while also providing instant claim settlement for customers;

- provide fitness trackers and apps for the health insurance segment;

- provide vehicle tracking devices for automotive insurance;

- implement all sorts of similar sensors and trackers that feature truly dynamic, intelligent underwriting algorithms.

Unlike other industries, insurance agents do not interact with customers on a regular basis. Therefore, the ability to use customers’ data to understand their preferences is extremely important. AI can be useful in collecting data, sorting the information, and providing accurate customer’s profiles. You can call it a revolution in a digital world.

However, there are certain risks in using artificial intelligence in the insurance sector. It may increase the vulnerability of companies to cyber-attacks and technical failure, leading to larger losses and disruptions. Companies will also face difficulties in transferring responsibility from person to machine and its developer. A new concept of risk management is necessary, taking into account potential failures caused by the use of artificial intelligence.

Machine Learning

Machine learning has great potential in the InsurTech insurance sector, especially in predicting the risks. Machine learning is ideal for software collecting data from the IoT sensor. They can be installed at home as a part of the Smart house system or in a car (telematics).

However, the use of technology in the insurance sector is not limited by the mentioned solutions. Pre-trained machine learning examples are helpful for systemizing unstructured data: transcribing calls, recognizing the handwritten records, identifying the assigned risk, etc. You can use the technology to program the chatbots so they would speak like a real person. Risk modeling, underwriting, claims handling, and distribution technology are the most important reasons to consider using machine learning for your insurance company.

Internet of Things

The Internet of Things (IoT) is a network or system of interconnected devices, sensors interacting with other devices through the Internet. These objects, or “things,” have memory cards and processors, which allows transferring data to other devices. You can also program them to implement certain actions and react to external circumstances.

This technology is not new and is already common in the InsurTech industry. There are devices to control a person’s health, sensors to put on transport, geographic information systems (GIS) and many more.

60% of insurers believe that they can change consumer behavior by leveraging the IoT in the nearest future. They will carry out not only quantitative but also in-depth qualitative analysis of data on insured objects. Now insurers only compensate for the damage, but soon you may be able to forecast the potential damage. The integration of IoT technology will contribute to the development of new reinsurance products and services.

Smartphone Apps

The mobile market is constantly growing, and so is the number of people using smartphones worldwide. Startups need to adapt to the new trends and the insurance industry is not an exception. The Mobile Health market alone is set to exceed $289.4 billion USD by 2025. Insurance companies will use mobile technology prevalently to interact with their partners and customers.

Nowadays, a potential client of an insurance company does not always visit the website looking for the necessary information. A mobile application solves this problem and saves time, and the company grows its customer base.

A full-fledged Insure tech application may help with:

- finding out more information about the company and services;

- integrating marketing technology;

- selecting suitable service packages;

- calculating the cost of the insurance policy;

- buying an insurance package without visiting the office;

- contacting the insurance agent.

Another application example is the app for insurance agents. They are constantly on the move, meeting potential clients and making deals with the partners. Additionally, they fill out documents, keep records, and write reports. It takes a lot of time, which could have been spent on communicating with customers. A mobile application allows to optimize the workflow, increase the agent’s motivation, and reduce the cost of daily tasks. To ensure this, it is enough to provide quick access to the company’s data, marketing materials, and tools for making deals outside the office.

Blockchain

Development based on the blockchain technology, dedicated to automating the insurance industry, is a very promising direction. In this area, the technology is already used to mitigate the above-mentioned challenges of protecting, managing, sharing, and monetizing large volumes of data, implementing third-party transactions, and setting up optimal reinsurance—all with the help of smart contracts, separation by blocks within a centralized network, and good deal of automation.

Insurers face difficulties with assessing all the risks to estimate the cost of the insurance policy and quotes they can afford. The parties often make a deal without having reliable information about the insurance object and not trusting each other. For example, the policyholder may remove information about illnesses from a medical card or the car seller may conceal information about unrecorded minor accidents.

To remedy the situation, insurers are considering blockchain, which is hard to fake. Blockchain can be described as a digital notebook that has many owners. You can make new entries, but you cannot correct the existing ones. The blockchain technology helps eliminate double compensations for one insured case. The system immediately documents the violation.

As much as this tech concept is fruitful and promising, though, it still has to overcome many legal and regulatory hurdles to become an insurance industry standard. The possibilities in that aspect, however, are limitless and are being explored far and wide by acting companies and startups alike on a regular basis.

Big Data

Successful insurance companies should have a planning and reporting software. It consists of data storage, RegTech solutions, analytical and reporting tools. Big Data is used to better understand customers, their behaviors, and preferences. Companies seek to expand their customer databases using social media and text analytics to get a more detailed picture. The main goal is to create predictive models.

Drones

Drones are not an insurance-focused solution, yet they still bring innovation to the insurance process in many ways. They are very helpful for collecting accurate data and evaluating it immediately after the insured event. In particular, there’s Betterview, which offers property inspection services by drones, which can get you hi-res images of residential and commercial properties from a bird’s-eye panorama and all around.

There is also a Cloud-based software suite that comes along with the services, which allows customers to sort, store, and analyze the captured images to facilitate and support insurer’s underwriting inspection, loss control, and claims adjustment processes.

Cybersecurity

Cybersecurity solutions for insurance are there to help insurers cope with increasingly advancing and spreading cyber risks. On top of that, common operations in the industry imply working with huge amounts of personal data, which are fast to be targeted by users with criminal intent that realize how underprotected a company’s way of doing business might be.

With transactions, data storing, and many other related processes sweepingly migrating to the online realm, the need in data protection becomes even more important. Industry surveys say that only about a half (43% to be exact) of most existing insurers believe that they are prepared for digital attacks.

To tackle cybersecurity issues efficiently, the whole company must put protective measures in a serious focus, collaborating between departments, prioritizing transparent in-house communication, and planning cyber response guidelines.

Driverless cars

The development of artificial intelligence will greatly influence the car insurance industry. As there will be more unmanned vehicles, the very need for insurance is questioned if the human factor can be excluded from the driving process. If driverless cars become the norm, hacking can be one of the most common insurance claims, so cybersecurity will be a key factor here.

Research by KPMG forecasts that the rise of autonomous car technology could reduce the car insurance industry by 71% by 2050.

“Inevitably, deeper connections are likely to develop between OEMs and the insurers that remain around new car purchasing methods and financing models. These relationships will rely heavily on the insurer’s value-add with regards to both data translation and internet of things platforms.”

– Andrew Bennett, Chief Executive at Insure Telematics Solutions

Challenges and Future of InsurTech Space

Today, the major areas for the development of insurance technologies are telematics, Big Data, machine learning, artificial intelligence, smartphone apps, and cybersecurity. The world is committed to selling everything online, and the insurance industry will keep up with global trends.

Insurance companies are preparing to exchange data with their clients. They integrate smart home systems and track client’s health data via special devices.

There are already remote trackers that inform about the patient’s health and constantly analyze all major health indicators. The insurance company can receive this information and forecast incidents. These technologies will primarily change the auto insurance market, and in the future will affect health insurance.

Leaders and Influencers

You can estimate the insurance market in each country by the volume and growth rate of real insurance premiums. Simply put, it means how much money insurance companies receive from the sale of policies. For many years the US has been an indisputable leader in the world. Several of the biggest insurance companies have their headquarters in the

States and sell policies mostly in healthcare and property.

Germany, the United Kingdom (making up 14% of the global ecosystem), and Asia are all exploring Insurtech in different ways. Insurtech in Asia is starting to ramp up, with Hong Kong and Singapore paying attention to the startup frenzy coming out of Europe and the US.

Lemonade is, probably, the most well-known Insurtech startup to-date, which is a peer-to-peer, AI-driven insurer based in the US. The startup has been the talk of the town for the most part due to the full range of insurance services it offers, backing by reinsurers, and attractive marketing offers for customers.

Friendsurance, however, is the first and original peer-to-peer insurance company from Germany that paved the way for the Insurtech companies galore

The main players on the market define the future of InsurTech. They are influencers for other smaller companies that analyze the trends and the stories of success, bringing tech solutions into their working ecosystem. You need to assess competitors and search for technologies and programs to keep up the pace.

Criticism of InsurTech

Along with the high tech solutions that can significantly improve the workflow of the insurance companies, there are certain doubts about the common use of InsurTech. The job of an insurance agent is highly regulated and needs to apply to the legal system and regulation. The risks of financial losses should be minimized and there is no room for experiments. The technologies used should be accurate and reliable, providing efficient tools for data management and value chain. The tech insurance companies should eliminate the risks of cyber attacks and data leakage and present high level of security to their partners and customers.

Insurance Software Development with 4tifier

We know how difficult it can be to find a reliable outsourcing company ready to create custom InsurTech software according to your specific requirements. Our team is at your service, providing a business development plan and consulting you at every stage. Fortifier provides state-of-the-art tech solutions for InsurTech startups.

Our team analyzes the needs of your company, challenges and development strategy to present the most effective solutions for your case. Our next step is to understand the customer’s behavioral patterns to create a better user experience. During the development, we follow our reliability standards to ensure the scalability and quality of the software architecture. At the last stage, our professional testing team is in charge of checking the software to make sure it is bug-free and functions properly.

Conclusion

The world around us is changing and emphasizing the role of technology in addressing a lot of the challenges that we face. The insurance sector needs applied technologies to develop the services and to improve customer experience. Tech decisions are also important in terms of financial health and growth. Look closer at InsurTech’s meaning in the modern business models to bring innovation to the insurance industry.

Do you want to bring your insurance company to a new level? Then, InsurTech tools are what you need. You can rely on Fortifier as we follow our own custom standards while working on a project for you. Contact us today to choose your InsurTech solution.