The global digitalization and millennials force insurtech companies to respond to competition and take up insurance software development in order to be able to provide innovative, efficient technological solutions for this field of business.

With the employment of readily-available advanced tech solutions, like AI, Big Data, Machine Learning, IoT, etc., and assistance of seasoned, dedicated professionals, you get all the chances in the world to keep your insurance business at the top positions in the market.

Software Development for the Insurance Industry

Customer-centered software development services greatly help insurance agencies and individual insurers to improve operational efficiency and deliver innovative software solutions to the market faster. Advanced tech for business automation allows getting rid of loads of unnecessary manual paperwork and such while in-depth AI-based tech helps to manage claims and policies as thoroughly as never before.

Outsourcing bonuses

IT outsourcing companies obtain appreciable expertise in terms of cooperating with ventures in associated fields (e.g. Fortifier offers core competencies in the realm of healthcare as well as insurance fields), experience in such groundbreaking technology innovations as blockchain and alike. Your subcontracting partner tends to assist you in enhancing the transaction safety rate, automate workflow, plus give valuable insights regarding ways of advancing insurance procedures via innovative technologies.

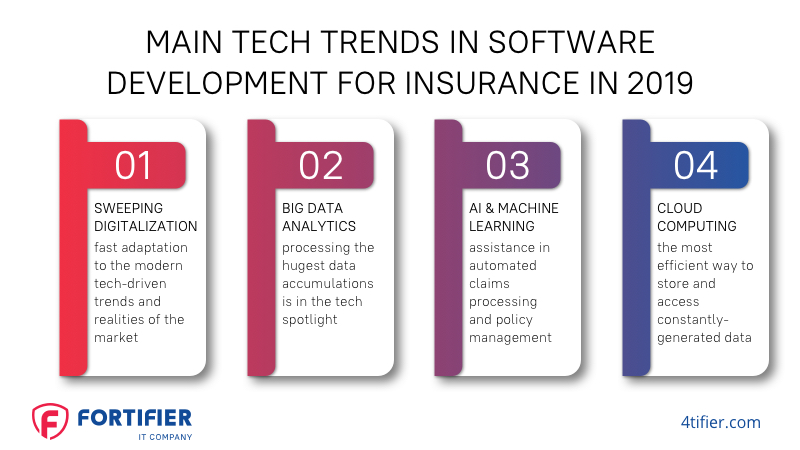

Main Tech Trends in Software Development for Insurance in 2019

Sweeping digitalization

Far-seeing insurance agencies and insurers are fast to adapt to the modern technologically-driven tendencies and realities of the market. That implies transferring many business processes from the limited confines of physical offices.

Big Data

Considering colossal amounts of info insurance processes usually generate as well as the constant need in storing all these data volumes for prolonged periods of time, Big Data, with its capability to process the hugest data accumulations is in the tech spotlight.

AI & Machine Learning

Smart neural networks along with the ability of AI-based processes to self-learn based on previous experiences provide huge assistance in automated claims processing and policy management, with the overall preciseness unmatchable by human efforts.

Cloud computing

Getting back to the issues related to huge amounts of data generated by insurance processes, the most efficient way to store and access constantly-generated data volumes is through cloud repositories, without overloading in-house hardware.

4 Outsourcing Advantages of Custom Insurance Software Development at Fortifier

With the insurance software solutions development by Fortifier as your dedicated outsourcing dev partner, you get:

- A wide range of high-quality, cutting-edge insurance web & mobile software to meet your every business demand, including such solutions & services as:

- Native, cross-platform & hybrid mobile applications as well as desktop insurance software development of any complexity;

- Digital platforms to help insurers deliver better services & boost profits;

- Development & integration of chatbots or voice bots for thorough FNOL automation;

- Implementation of text and/or image recognition solutions for automating manual data input;

- Integration of geolocation services;

- Development of Insurance coverage calculators;

- Reliable software product development for automating internal processes & improving insurance workflow.

- Employment of the latest, advanced technologies to set your business at the forefront of the market, such as:

- Internet of Things powers for efficiently, conveniently evaluating business risks & customizing policy costs in a reasonable way;

- Predictive analytics for thorough risk management & increased efficiency of marketing campaigns;

- Computer Vision for precise damage estimation;

- Artificial Intelligence & Machine Learning for FNOL automation, identifying assigned risk, & enhancing the customer experience;

- Blockchain & social network analytics for fraud detection;

- Big Data for better understanding of customers as well as the creation of useful predictive models.

- A highly-qualified team’s reliable performance for handling any issues & tasks in the most optimal terms. We provide dedicated experts that:

- Possess extensive experience & are very well seasoned in terms of the insurance domain software development & other points of expertise;

- Delivered over 20 long-term, fully-implemented, deployed, & supported projects for insurtech & insurance projects;

- Have been delivering insurtech & insurance technology solutions along with product designs of all sorts for striving startups non-stop due to the extensive technical expertise.

- Overall long-standing expertise in the software development for the insurance industry. We employ the industry-specific expertise in insurance software solutions development, providing market-leading performance in terms of:

- Underwriting for guaranteed, protected deals;

- Claims policy management for a thorough inspection of claims & respective policies, and cover everything from policy administration to claims compensation;

- Fraud detection for your insurance activities’ reinforced security;

- Risk assignment for efficient prevention of potential risks and errors as well as any additional expenses.

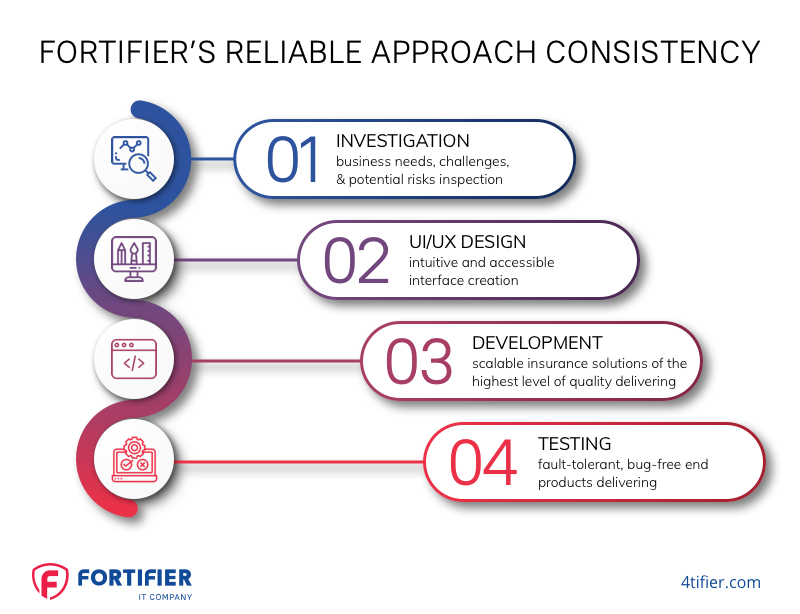

Try Fortifier’s reliable approach to keep ahead of the competition and get efficient tech solutions for your insurance business

We perfectly realize that your main point and goal as an insurance provider is to deliver the utter reliability of service and factual protection of lives so let us provide efficiency, reliability, and protection for your efforts, and make your cause easier and painless with:

- Step 1 – Investigation. Fortifier’s analysts and managers inspect your business needs, challenges, & potential risks in order to initiate the most optimized, cost- & time-efficient project. We provide an estimated budget & project timeline once all the analyses are settled with you.

- Step 2 – UI/UX design. Based on the thorough analysis & composition of your target audience’s portrait, our designers create an intuitive, accessible interface in order to achieve the top-notch seamless user experience.

- Step 3 – Development. We follow the Reliability Standards & employ polished risk management procedures to deliver scalable insurance solutions of the highest level of quality in the shortest, most reasonable terms.

- Step 4 – Testing. We take care of any possible flaws & errors before any actual damage is done to the UX you provide & your business reputation, delivering only fault-tolerant, bug-free end products.

Cost of Fortifier’s Customized Insurance Software Solutions

How much will your custom software product ultimately cost?

For your and your wallet’s convenience, we offer 3 cooperation models to choose from:

| Coop Models | Description | Limitations | Advantages |

|---|---|---|---|

| Time & Materials | An optimal option if you need to adjust to the complex project workflow in the process of cooperation, thus, getting utterly reasonable cost & time expenses. | Approximate initial planning that expands along the progress of the project. |

|

| Dedicated Team | We assemble a dedicated team in close correspondence with your main demands & goals that is also fully responsive to your commands, can be managed & scaled along the project progress. | No third-party involvement. |

|

| Fixed Price Budget | The best model for projects with pre-calculated expenses which Fortifier will assess further & propose the most optimal budget as well as the development strategy, no spontaneous adjustments involved. | A reasonable restriction in making excessive adjustments throughout the project workflow. |

|

Flexible readymade sets of IT service packages

We also offer flexible insurtech service packages you can select individually or combine at will. We simply want to make sure that, as an insurance software development client of ours, you get the widest freedom of choice possible so that your future end product comes out optimal in all aspects (cost, terms of development, correspondence with the business needs, etc.):

- Creation of POC – Proof of Concept. Get a dynamic prototype for your product concept (with requirements specification, wireframe + UI markup + UX dynamic prototype, software architecture diagram, etc.) to attract investors & raise funds for further development & support.

- Reliable Development. Employ cost-efficient software development, quality assurance, & all that comes along with the full-cycle software project development or profitably enhance your existing product with the high outsourced expertise.

- MVP. Get a minimum viable product – a software product with the minimum of necessary functionality & maximum of the potential’s description – & grow it by acquiring interested investors & making some buzz in the niche.

- Technical Audit. Engage Fortifier’s professional services to сonduct comprehensive review of your current digital solutions, receive a proper warranty report, plus receive recommendations for further code optimization.

- Integration & Maintenance. We properly integrate new software products with your existing business systems & provide further technical support.

Summary

Create solutions for facilitating and optimizing your insurance processes, measure, and control risks, reduce costs, and improve the efficiency of your business with Fortifier.

Contact us via the website form or call us – +1 650-772-4259 – or hit us up via email – sales@4tifier.com and our Manager will readily reply and consult your upcoming insurance software development project within 24 hours.